According to on-chain analysis, some Ethereum indicators are showing signals that whales are continuing to accumulate the cryptocurrency.

Ethereum Shows Negative Netflows As Exchange Reserves Continue The Downtrend

As pointed out by a CryptoQuant post, ETH indicators seem to be moving in directions that suggest whales are continuing to accumulate.

There are three important metrics to consider here: the all exchanges netflow, the all the exchanges reserve, and the unique Ethereum 2.0 depositors count.

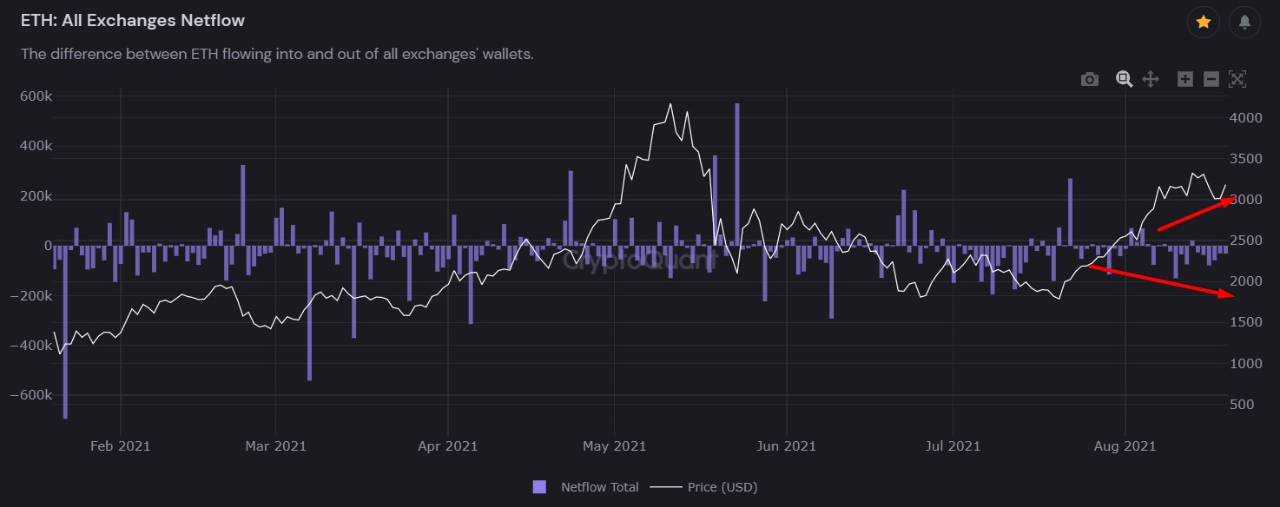

The all exchanges netflow is an indicator that shows the net amount of ETH entering or exiting centralized exchanges.

When the metric has a negative value, it means more coins are being transferred out of exchanges to personal wallets than the crypto entering in. Such a value could indicate a buying pressure in the market as more investors are interested in hodling or OTC deals.

A positive value suggests just the opposite; exchanges are receiving more Ethereum than the amount moving outwards, and thus there could be a selling pressure in the market.

Here is how the ETH all exchanges netflow chart looks like:

Ethereum continues to observe negative netflows

As the above graph shows, the indicator has been showing negative spikes for the cryptocurrency recently. Negative netflows are usually associated with an increase in the price, like the uptrend the crypto is experiencing right now.

Related Reading | Institutional Investors FOMO For Ethereum Exposure

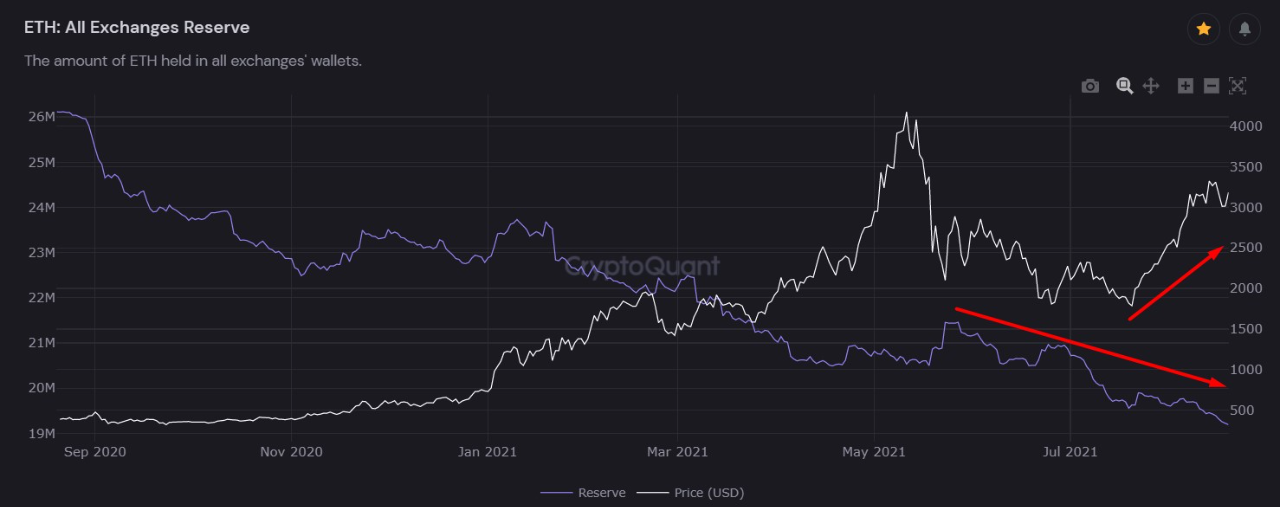

The next indicator is the all exchanges reserve, which gives the total amount of ETH present in exchange wallets. A rise in this value means more ETH is being transferred to exchanges for selling purposes. Similarly, a decrease means more investors are looking to hodl their coins in personal wallets.

Below is the chart for the Ethereum all exchanges reserve:

The Ethereum all exchanges reserve continues the downtrend

Looks like the value of this metric has been going down in recent months. The trend makes sense as the netflows have been largely negative during the period.

Such a decrease in the exchange reserves means more whales are continuing to accumulate ETH rather than looking for a dump.

Related Reading | TA: Ethereum Prints Bearish Technical Pattern, Why It Could Nosedive

Finally, there is the ETH 2.0 unique depositors count that shows the number of accounts who have staked at least 32 ETH.

The metric’s value has been going up as more of these whales are becoming interested in staking their coins, as the below chart shows:

The ETH 2.0 depositors count goes up

Ethereum Price

At the time of writing, ETH’s price floats around $3.2k, up 1.8% in the last 7 days. Here is a chart that shows the trend in the price of the cryptocurrency over the past three months:

After a plunge, Ethereum's value is now sharply going up | Source: ETHUSD on TradingView

Featured image from Unsplash.com, charts from CryptoQuant, TradingView.com