This weekly roundup of news from Mainland China, Taiwan, and Hong Kong attempts to curate the industry’s most important news, including influential projects, changes in the regulatory landscape, and enterprise blockchain integrations.

After enforcing global KYC requirements for all users, Binance’s dominance in CeFi has slipped from about two-thirds to just over one half, according to the FTX volume monitor. The big three of Huobi, Binance and OKEx now look like a big five, with Hong-Kong based FTX and Singapore based Bybit closing the gap.

The global NFT fever seems to be intensifying in a week that saw Visa make headlines with its $150,000 purchase of CryptoPunk 7610. Chinese netizens on Weibo were unsurprisingly baffled, with comments asking what can be done with it after purchase, while others made jokes about whether or not a Punk had any artistic value. Since late June, daily searches for ‘NFT’ are now measuring between 2.5 million and 4 million, showing a growing interest in the asset class.

Related: Shanghai Special: Crypto crackdown fallout and what happens next

Owning Bitcoin isn’t banned, but many fear for the future of regulations in China. Here’s a look at where we stand and where we might be headed.

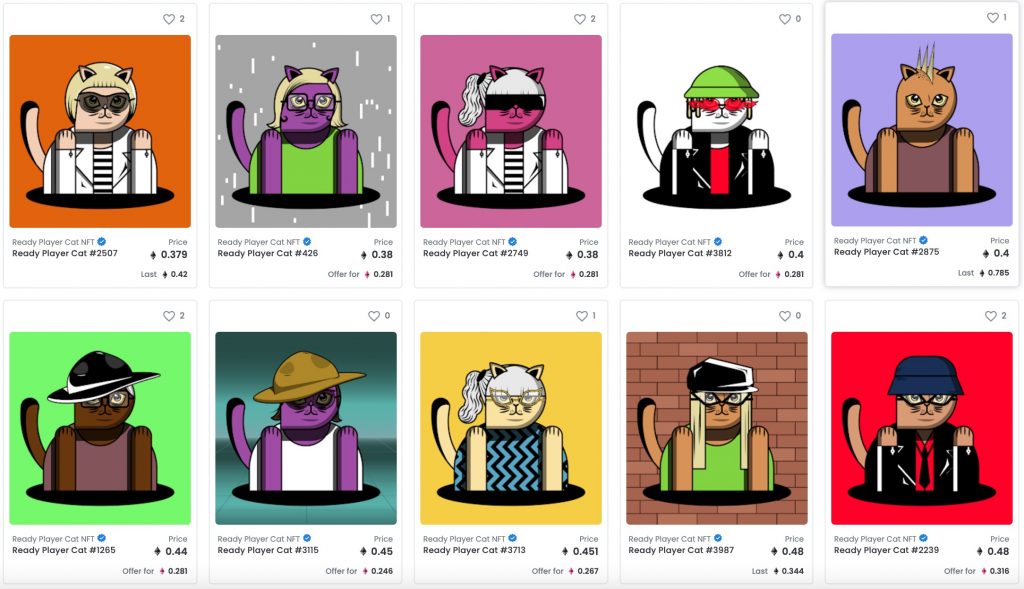

Meet the MAODAO

The MAODAO is one of the first NFT communities to spring up in Asia, with a focus currently on China. It’s based around play-to-earn gaming, with the DAO sponsoring players in the Axie Infinity world by providing assets upfront, and then returning a portion of the proceeds back to the DAO treasury. The DAO uses NFT cats used as both a collectible and a governance token. These Ready Player Cats, or RPCs for short, are 3000 NFT cat tokens that were minted on August 22nd for 0.08 ETH. The colorful cartoon cats now have a price floor of near 0.4 ETH.

Speaking to the founder who goes by the name of Matt Mao, we learned that a lot of inspiration had come from another famous NFT project, Bored Yacht Ape Club.

“Our most prominent characteristic may be our Eastern roots. In fact, our first minting event was mostly done by early supporters of the Asian NFT and crypto community. Maybe everyone’s enthusiasm stemmed from the lack of a symbolic NFT project in the Eastern community and gave some recognition to us.”

Mao is planning to leverage the abundant resources the crypto community has to grow and raise awareness, strengthening the exchange between Western and Eastern NFT communities. The outfit is planning cooperations with other artists and projects to increase rewards for the MAODAO and its members.

Alls well that ends well?

After a long and dramatic journey, the dramatic Poly Network hacker returned the rest of the funds to the cross-chain bridge. The hacker had exploited a bug in the code to lift over $610 million in Ethereum and other cryptocurrencies, before leading the cryptocurrency space on a wild ride that included failed attempts to avert a blacklist, sending funds to Vitalik Buterin, and an AMA via the blockchain. Poly Network, which is a project incubated by Neo’s O3 labs, will be glad to have their users’ funds back, although it remains to be seen if the project can continue now that so much trust has been eroded.

Objection overruled!

A high court from the Northeast province of Shandong set a precedent when it ruled that a plaintiff’s cryptocurrency had no legal status in China. The plaintiff in the case had lost around $10,000 dollars worth of tokens when a People’s Bank of China ruling back in 2017 had ordered exchanges to close. The plaintiff had lost access to his account and was hoping to get the value of the tokens back on the grounds of fraud. It’s unknown whether the judge had reminded the plaintiff at the conclusion of the case that if it’s ‘not your keys, not your crypto.’

This contradicts a ruling from earlier this month in a district court of Shanghai, that ruled Bitcoin was a property protected by Chinese law.

The Minhang District Court in Shanghai stated that Bitcoin is a virtual property protected by Chinese law, which is disposable, exchangeable and exclusive. https://t.co/lUO3yr44Vw

— Wu Blockchain (@WuBlockchain) August 18, 2021

The lack of clarity and consensus on the issue is slightly unusual for China, where top-down leadership can usually set clear directives to follow. It’s possible that with the government’s emphasis on blockchain development, emerging tech, and upcoming central bank digital currency, the government is hesitant to put a blanket ban on digital assets.

Heading West for summer

Bitcoin and Ethereum miners appear to be completing their migrations abroad following the strict regulation against them earlier this summer. This is based on the hash rate data recovering to around 66.7% of it’s pre-regulation peak in May. During the summer, most of the large mining companies have been closing down operations and shipping hardware to other countries, including Kazakhstan, Bangladesh, and the US. This rebound signifies that the mining industry and the network as a whole has emerged from another major threat. Now that the network has moved away from being so centralized within China, it should become more appealing to risk averse investors.