During the last 12 months the stablecoin economy has grown massive and the current valuation today is only $13 billion away from tapping the $200 billion mark. This month, the two biggest gainers in terms of 30-day issuance include Terra’s UST jumping 29.9% and Neutrino Protocol’s USDN spiking 43.8%.

Stablecoin Market Capitalization Continues to Swell, Tether Crosses $80 Billion

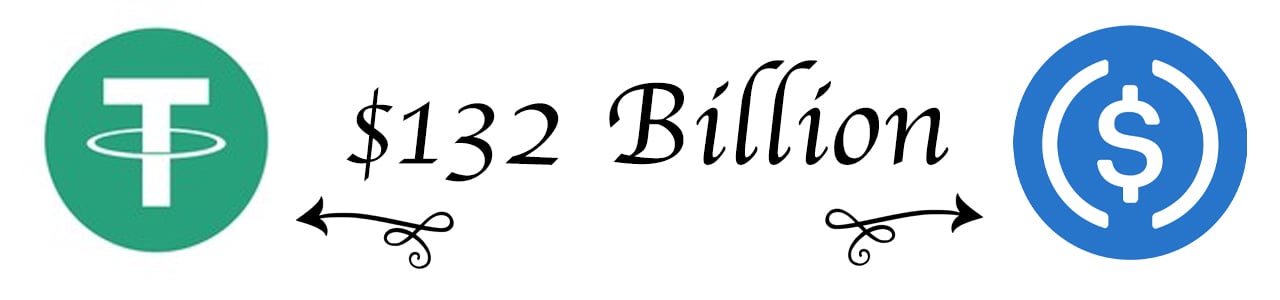

Monthly statistics show the largest stablecoin in terms of market capitalization, tether (USDT), increased by 2% this month as the valuation crossed the $80 billion mark. USDT is massive compared to the rest of the stablecoins in the crypto economy as its valuation represents 42.78% of the $187 billion stablecoin economy today.

Furthermore, tether’s $80 billion market capitalization equates to 4.46% of the entire $1.83 trillion crypto economy. The second-largest stablecoin in terms of market capitalization, usd coin (USDC) only increased by 0.3% this past month.

USDC has a market valuation of around $52.3 billion today which equates to 2.92% of the crypto economy and 27.96% of the stablecoin economy. Metrics on March 14, 2022, indicate that between USDC and USDT, the market capitalizations combined equate to more than 70% of the entire stablecoin economy.

The top assets exchanging hands with tether (USDT) is the U.S. dollar with 42.16% of today’s share and the Turkisk lira (TRY) with 17.41% of tether trades. TRY is followed by the euro, WBNB, and HUSD. USDC trades a lot with tether as USDT represents 64.18% of Monday’s tether swaps. BUSD, USD, EUR, and WETH all follow tether as the top pairs trading with usd coin (USDC).

USDN, UST, and FRAX Record 30-Day Issuance Rises, Stablecoins Command 10% of the Entire Crypto Economy’s Net Value

While USDT and USDC did not see any significant increases over the last month, UST, FRAX, and USDN saw their 30-day issuance rate rise. Terra’s UST increased by 29.8% and today, the stablecoin has a market capitalization of around $14.7 billion at the time of writing.

Frax (FRAX), saw its 30-day issuance rate jump by 9.6% and Neutrino Protocol’s USDN rose by 43.8% during the last month. FRAX has a $2.9 billion market valuation and USDN commands a $638 million market capitalization today.

Makerdao’s stablecoin DAI, saw issuance levels dip during the last month down 4.6% and magic internet money (MIM) saw a loss of 0.2% this past month. The Ethereum-based DAI has a $9.3 billion market valuation, while the Avalanche-based MIM has a $2.7 billion market capitalization.

Overall, the entire stablecoin economy only has $13 billion more to rise before crossing the $200 billion zone. At the time of writing, the $187 billion stablecoin economy represents over 10% of the $1.83 trillion crypto economy.

What do you think about the stablecoin economy’s continued growth? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer