Over time, the crypto market has maintained a close relationship with the stock market. Ethereum, the second-largest cryptocurrency, rose in lockstep with U.S. stocks for the first time in February. As a result, the token’s 40-day correlation coefficient with the S&P 500 reached 0.65.

Despite the brake anxious investors have put on price activity in the past week, the Ethereum (ETH) price is poised to rise over the weekend. Although trading volume has increased over the last week, and thus should have resulted in more consistent fluctuations, price responsiveness has been affected by geopolitical news, earnings, and stock market whipsaws.

Ethereum Price Witnesses Turbulence

The price of Ethereum has had a grueling week for investors and traders, with large swings in response to earnings, geopolitical events, and investors turning from risk-on to risk-off like a light switch. But with volatility comes opportunity, and as all of these events wind down towards the weekend, bulls will have the playground to themselves and can drive the price up to $3,500 if they pick the right entry levels. Expect the RSI to rise over 50 again, with lots of room before trading into overbought territory.

According to statistics from Santiment, a crypto market behavior analysis tool, Ethereum has a strong (+ve) correlation with the S&P 500 index. Following a 1.8 percent drop in the S&P 500 index’s figures, the price of ETH increased by 3%.

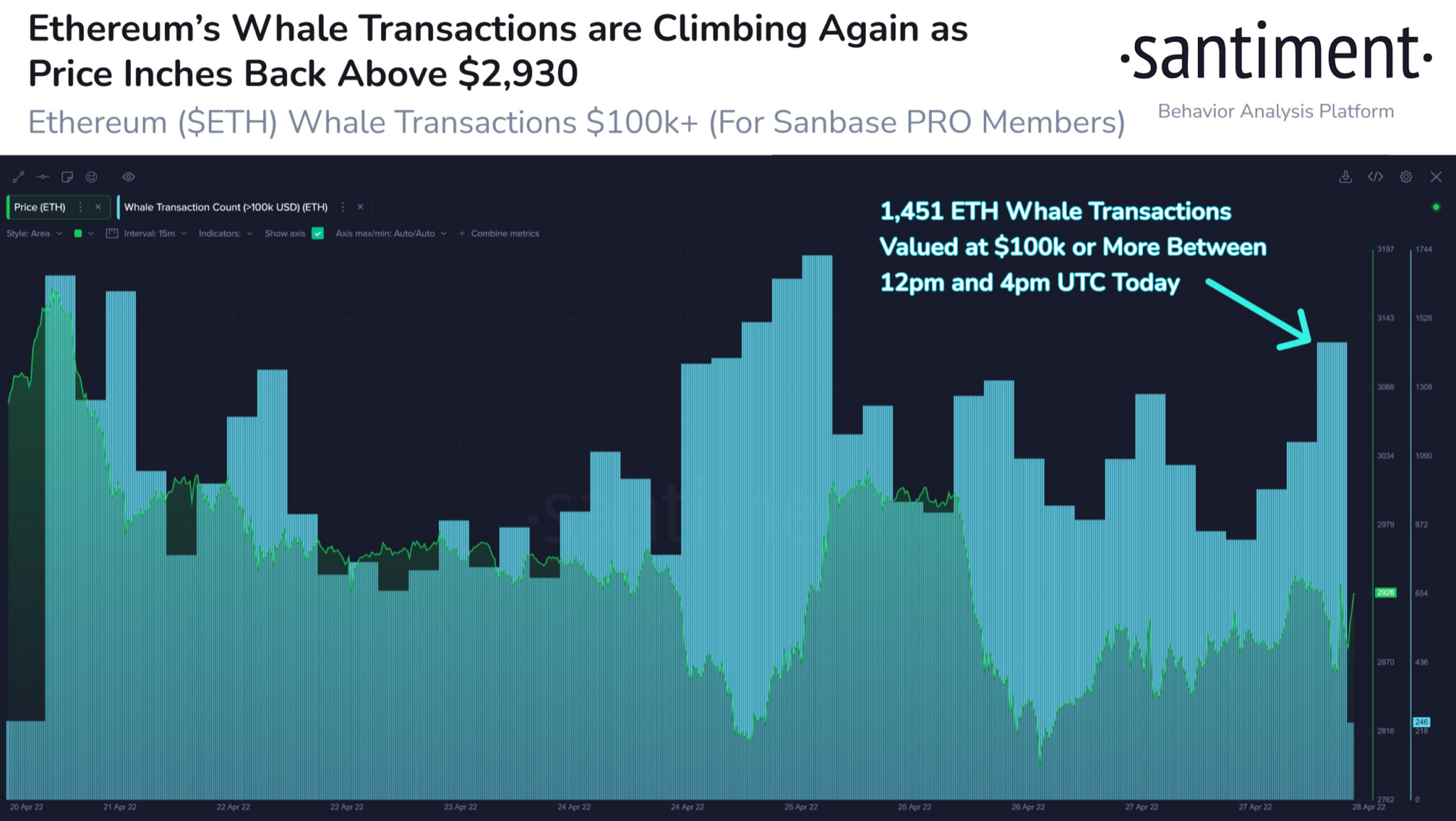

Source: Santiment

The tweet from April 29th added,

“Aided by a +1.8% day in the SP500, Ethereum has jumped back above $2,930 with its tight correlation to equities markets.”

Now, as seen in the graph above, ETH’s most powerful buyers, the whales, have retaliated by buying additional ETH. On that day, the number of whale transactions worth more than $100,000 surged dramatically.

In a four-hour period, 1,451 such transactions were documented. The jump, according to Santiment, suggested that key stakeholders were paying attention to the price increase.

Suggested Reading | Metaverse Tokens On Overdrive, Outpace Bitcoin And Ethereum

Is Equities Market Correlation Good For ETH?

This wasn’t the first time ETH had shown signs of a developing relationship with the stock market. The two sank together on March 31st, as reported three weeks earlier, but began climbing again after April 1st. Ether surged in tandem with the SP500 since mid-March.

Every positive situation in the crypto-verse is accompanied with a negative counterpart. That is, after all, a fact. This scenario is no exception. Crypto’s strong association with equities, in particular, might work wonders. Different reputable entities, on the other hand, have censored cautionary situations for the same.

ETH/USD has remained below $3k. Source: TradingView

Arthur Hayes, the former CEO of BitMex, raised warning flags about this link in this instance. Surprisingly, the stock market appears to be headed for a huge drop through 2022 as the Federal Reserve tightens monetary policy to battle inflation.

Related Reading | Bitcoin Futures Basis Nears One-Year Lows, How Will This Affect BTC?

Featured image from Pixabay, Santiment, chart from TradingView.com