Data shows a large amount of leverage has been piling up in the Ethereum futures market as the price of the crypto breaks above $2k.

Ethereum Open Interest Surges To Highest Value In Last 4 Months

As pointed out by an analyst in a CryptoQuant post, the ETH futures market has seen the leverage sharply going up recently.

The “open interest” is an indicator that measures the total number of Ethereum futures contracts currently open in all derivatives exchanges.

When the value of this metric rises up, it means investors are opening up more positions on the market right now. Since more futures positions imply that leverage is also going up in the market, such a trend can lead to higher volatility in the price of the coin.

On the other hand, lowering values of the indicator suggest holders are closing up their positions at the moment. This kind of trend can result in a less volatile value of ETH.

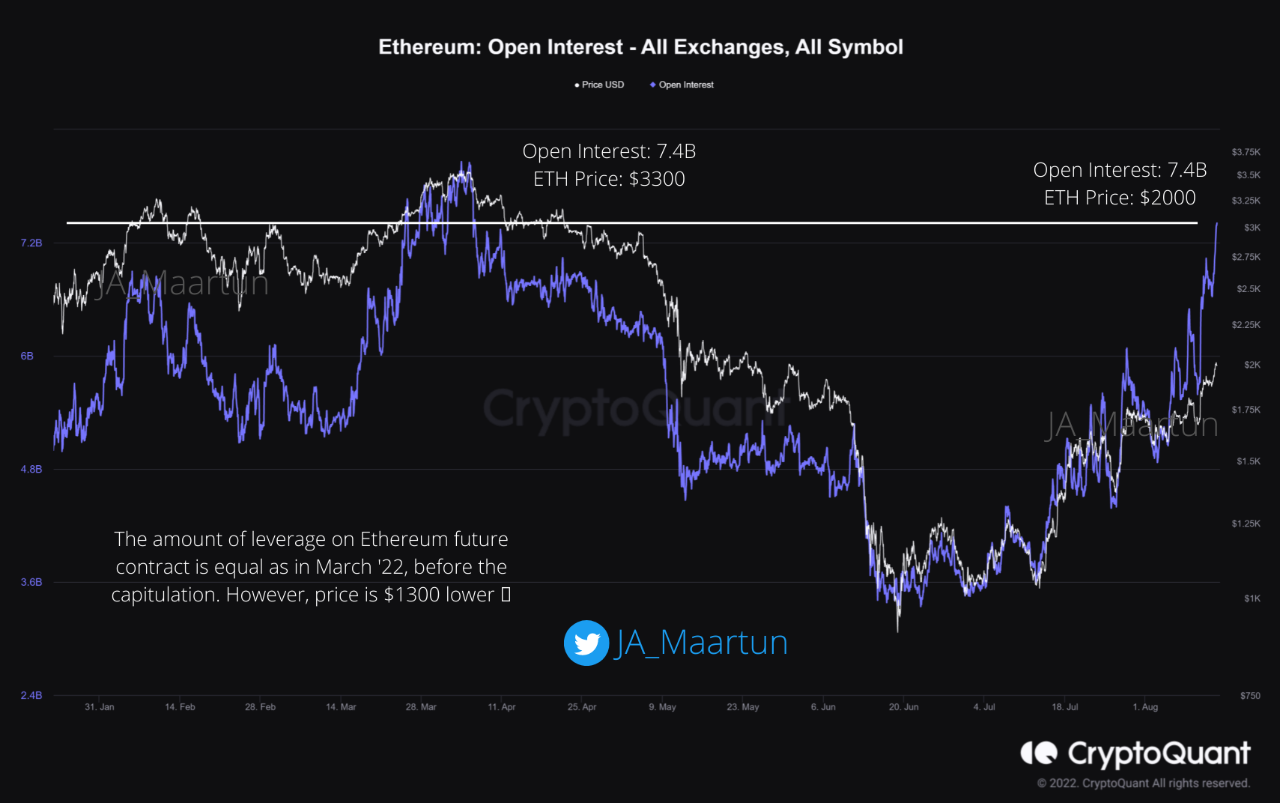

Now, here is a chart that shows the trend in the Ethereum open interest over the course of 2022 so far:

Looks like the value of the metric has shot up in recent days | Source: CryptoQuant

As you can see in the above graph, the Ethereum open interest has observed some sharp uptrend during the past couple of weeks.

The indicator has now reached a value of 7.4 billion, the highest it has seen during the last four months. However, there is an interesting comparison here.

Around 4 months ago, when such values were previously observed, the price of ETH was about $3.3k. But today the price is just $2k, around $1.3k less than it was back then.

And yet, the open interest is at the same level, meaning the Ethereum market might be having the same degree of leverage this time as well, while the price is much lower.

When especially high leverage accumulates in the futures market, any sharp swing in the price can liquidate a large number of positions at once. These liquidations then further amplify this price move, which liquidates more positions.

In this way, liquidations can cascade together, and the event is called a “liquidation squeeze.” This is the reason behind the volatility of an overleveraged market.

If a long squeeze does end up taking place this time, then the latest rally in the value of ETH may hit the breaks.

ETH Price

At the time of writing, Ethereum’s price floats around $1.9k, up 5% in the past week.

The value of ETH seems to have gone up during the last few days | Source: ETHUSD on TradingView

Featured image from Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com