According to an analyst on Dec. 29, 2022, the disgraced co-founder of FTX, Sam Bankman-Fried (SBF), may have cashed out $684,000 in crypto assets while under house arrest. If the funds were spent by SBF, it goes against the court’s release conditions that note the former FTX executive is not allowed to spend more than $1,000 without permission from the court.

Analyst Discovers Funds Tied to SBF’s and Alameda’s Wallets Moved While the FTX Co-Founder Is on House Arrest

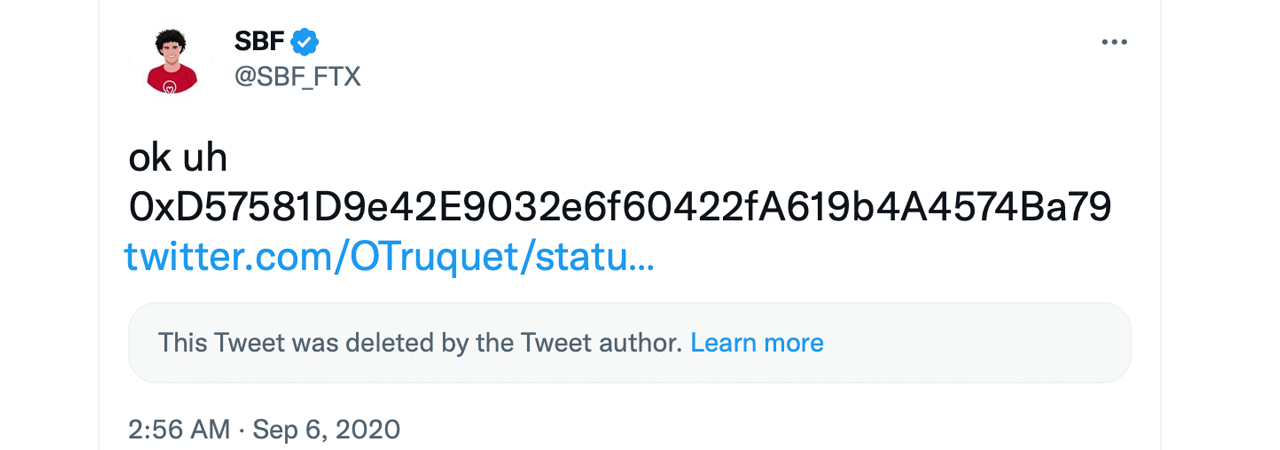

On Thursday, an analyst called “Bowtiediguana” published a Twitter thread that shows Sam Bankman-Fried may have spent $684K while he is on house arrest. According to Bowtiediguana, in August 2020, SBF agreed to temporarily take over the decentralized exchange (dex) Sushiswap, after the anonymous founder Chef Nomi decided to leave. When the deal was made, SBF shared a public Ethereum address and Chef Nomi transferred ownership of Sushiswap to SBF’s address.

“After SBF was released, his wallet sent all its remaining crypto tokens to a new Ethereum address created an hour earlier,” Bowtiediguana tweeted. “In 3 hours, over 100 new deposits were made to this wallet from various addresses, most having links to SBFs defunct hedge fund Alameda Research.” The analyst continued:

In less than [four] hours, 570 [ethereum] worth approximately $684,000 was transferred out of this new wallet, to various destinations. Funds were sent to a no-KYC exchange based in Seychelles and to the Bitcoin network via the [Ren Protocol], a bridge funded by Alameda. Perhaps the SEC attorneys would like notice of this?

The address in question is this ethereum address “which received a further $1M from 11 wallets labeled as Alameda Research,” Bowtiediguana said. “[Five] separate transactions of 51 ETH were used to move funds to newly created wallets [and] then onwards to a Seychelles-based exchange. [Three] tranches of 200K USDT were also sent from the SBF linked wallet to the Fixedfloat exchange,” the analyst added.

Bowtiediguana’s thread shows that an individual decided to email the information to the U.S. Securities and Exchange Commission (SEC) about the latest onchain movements. Others tagged the U.S. regulator in the Twitter thread and said: “@secgov u gave [SBF] 2 long of a leash sires. plz address this criminal.” It is unconfirmed at the moment as to who actually moved the funds, but many are speculating that it was SBF.

Since SBF’s arrest and his later release, FTX and Alameda-related funds have been moving, and transfers have been caught by onchain sleuths. Funds linked to Alameda were transferred two days ago and reportedly they were sent to Fixedfloat and Changenow and further converted into BTC. In another instance, an Alameda-labeled wallet sent 11.37 wrapped bitcoin (WBTC) to a wallet after removing it from Aave on Dec. 29.

The same day, another Alameda-labeled wallet sent 22,500 USDC on Dec. 29. Both of these transactions took place the day after a large swathe of ERC20 tokens linked to Alameda were moved on Wednesday, Dec. 28.

What do you think about the onchain movements caught by the analyst Bowtiediguana? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Editorial photo credit: Stephanie Keith / Getty Images

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer