Goldman Sachs has ranked bitcoin the best-performing asset so far this year. The cryptocurrency also tops the global investment bank’s list as the asset with the highest risk-adjusted return — above gold, real estate, the S&P 500, and the Nasdaq 100.

Bitcoin Outshines Other Investments on Goldman’s Chart

Global investment bank Goldman Sachs has reportedly ranked bitcoin the best-performing asset year-to-date (YTD). The Twitter account Documenting Bitcoin tweeted earlier this week:

Bitcoin is the best performing asset in the world this year, according to latest data by Goldman Sachs.

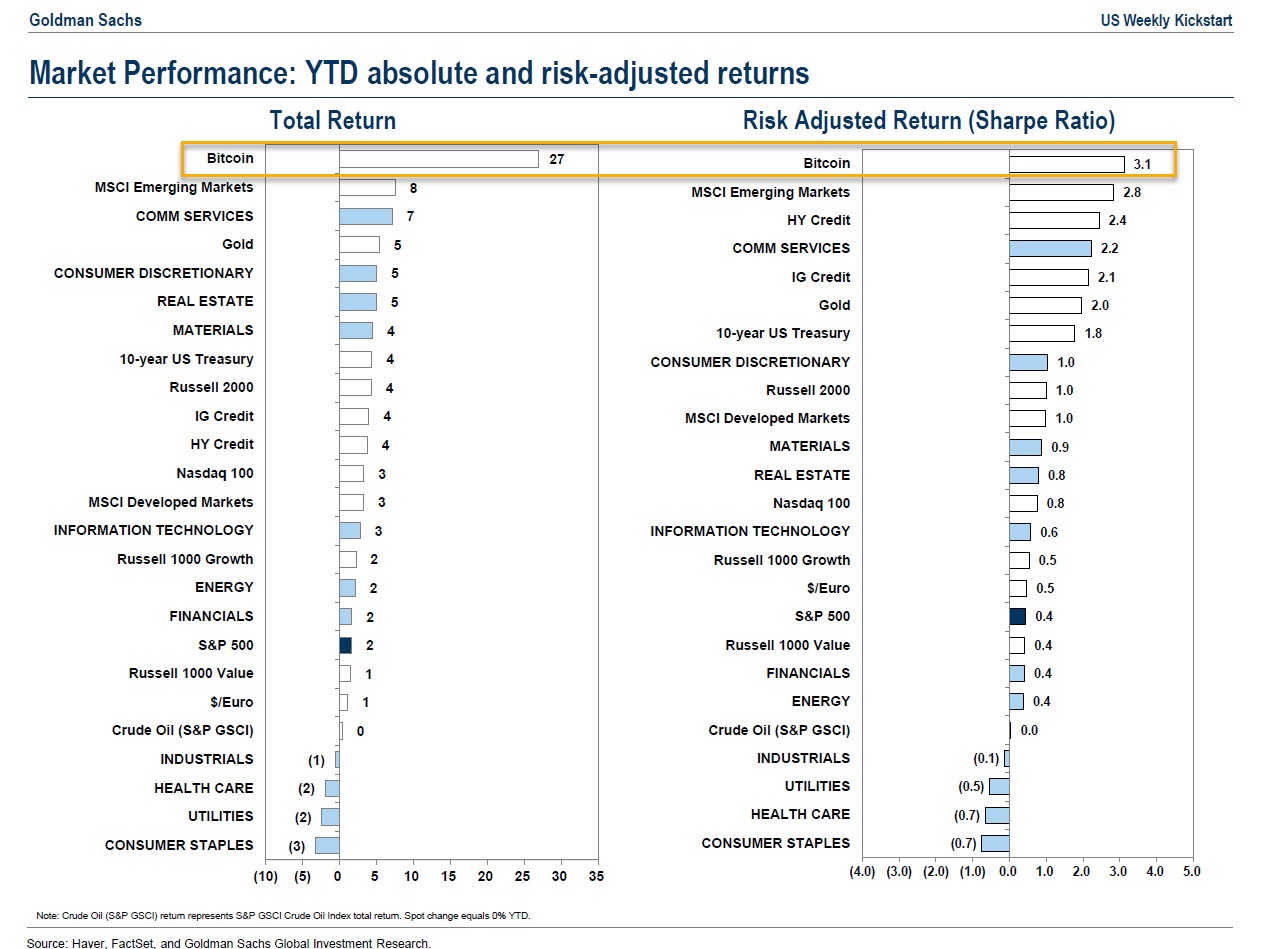

The tweet includes a market performance chart by Goldman Sachs showing the top 25 markets’ total returns as well as their year-to-date risk-adjusted returns.

Bitcoin tops the total return list at 27%, followed by MSCI Emerging Markets Index at 8%. BTC also tops Goldman Sachs’ risk-adjusted return list, with a Sharpe Ratio of 3.1. The price of bitcoin has risen since the firm published its chart. At the time of writing, BTC is trading at $23,130, up more than 39% so far this year.

Gold, which many people have compared bitcoin to as a store of value and a hedge against inflation, ranked several places below BTC on both the total and the risk-adjusted return lists. The metal has a total return of 6% year-to-date and a Sharpe Ratio of 2, according to Goldman’s chart. A higher Sharpe Ratio indicates that the investment has yielded higher returns for a given level of risk.

However, Goldman Sachs said in December last year that gold is a better “portfolio diversifier” than BTC since it is likely to be less influenced by tighter financial conditions. Furthermore, the bank’s analysts believe that gold has developed non-speculative use cases while bitcoin is still looking for one.

Goldman Sachs has been in the crypto space for several years. The firm formally established a cryptocurrency trading desk in May 2021. In January last year, the investment bank predicted that BTC could reach $100,000 as the crypto continues to take gold’s market share. Last year, Goldman Sachs executed its first OTC crypto transaction, offered its first bitcoin-backed loan, and launched a data service to help investors analyze crypto markets.

Do you think bitcoin will continue to be the best-performing asset this year? Let us know in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer