Ethereum has seen a 15% drop since hitting its recent high of $2,729 last Friday, leaving analysts and investors feeling frustrated with the price action. Many expected the bullish trend to continue, but Ethereum has struggled to maintain upward momentum.

Concerns are mounting as some market observers predict a deeper decline, possibly falling to yearly lows around $2,150 if the current support level fails to hold. This has reignited fear and uncertainty across the market as Ethereum’s price sends mixed signals.

Related Reading

The recent decline has shaken confidence, and market participants anxiously await a clear direction. Analysts are closely watching Ethereum’s next move and whether it can reclaim support levels to resume an upward trajectory.

The coming days are expected to be crucial for Ethereum’s price action, with investors bracing for heightened volatility in response to these shifting market conditions.

Ethereum Testing Crucial Support Line

Ethereum is now trading at a critical juncture that could define its direction in the coming week. Price action over the next few days is expected to be pivotal for Ethereum and the entire altcoin market. Analysts closely monitor whether ETH can maintain its strength as the second-largest cryptocurrency by market cap. Failing to hold above key support levels could signal a broader market decline.

Analysts and investors eagerly await an Ethereum recovery as it hovers above a crucial support line that could be the launchpad for a rally to new highs. One top analyst, Carl Runefelt, recently shared his insights on X, highlighting the current trendline supporting ETH price.

In his technical analysis, Runefelt warns that the price could drop significantly if Ethereum fails to hold this trendline. If the price breaches this support, he identifies $2,150 as the next potential target.

Related Reading

A fall to these levels would likely shake out many investors expecting a bullish continuation in the weeks ahead. If ETH loses this key support, it may lead to uncertainty and heightened volatility. This fall would keep market participants on edge while waiting for the next move.

ETH Price Action Details

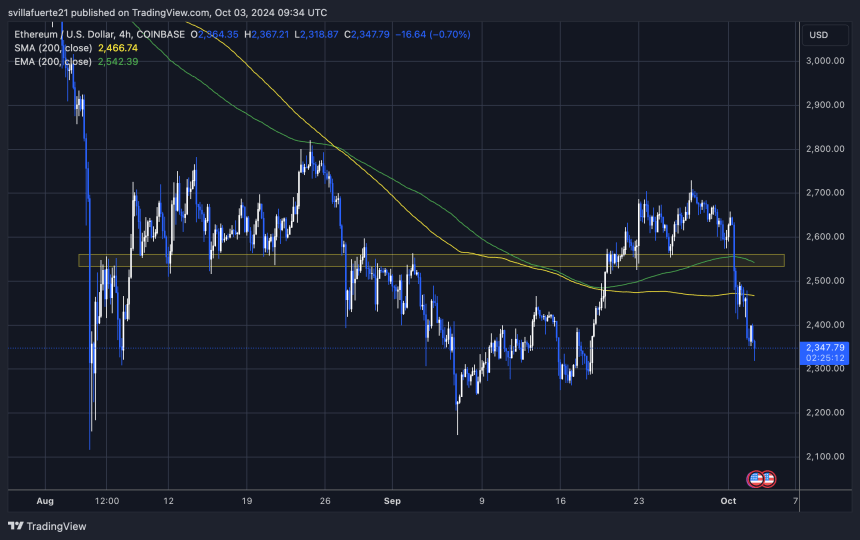

Ethereum (ETH) is trading at $2,350 after failing to establish a higher high above $2,820. This recent price action has disappointed bulls, as ETH has lost crucial support levels, including the 4-hour 200 exponential moving average (EMA) at $2,542 and the simple moving average (MA) at $2,466.

These indicators are key in determining short-term trends, and their loss as support has raised concerns about further downside risk.

For the bulls to regain momentum, ETH must break above the 4-hour 200 EMA and the 4-hour MA and successfully hold these levels as support. Reclaiming these indicators would signal renewed strength and pave the way for another attempt to increase prices.

Related Reading

However, a deeper correction is likely if Ethereum fails to recover these levels. Key support around $2,100 becomes the next target, with the potential for even lower prices. Investors are closely monitoring these levels, as the coming days will be critical in determining whether ETH can recover or continue its downtrend.

Featured image from Dall-E, chart from TradingView