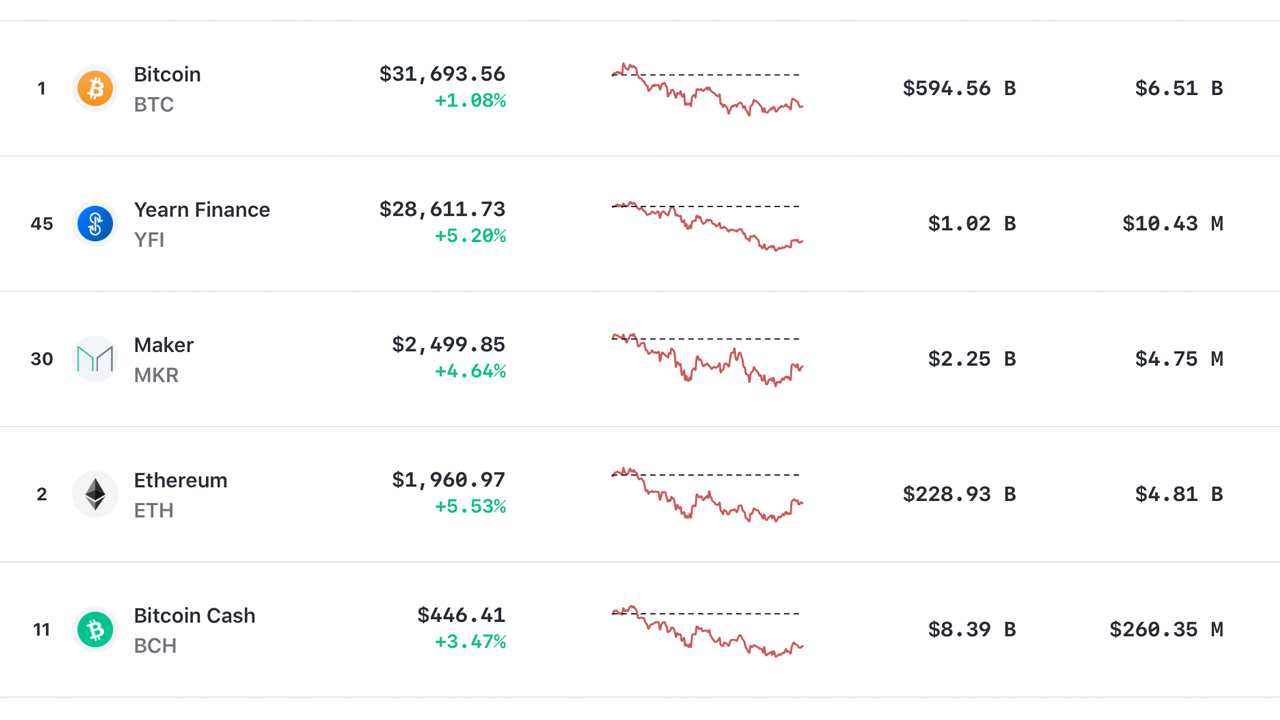

On July 18, the most valuable cryptocurrency in terms of dollars per unit, is bitcoin which is currently trading for $31,693. Besides all the wrapped bitcoins and synthetic bitcoin pegs, the second-highest valued crypto-asset per unit is yearn finance and maker follows behind. Removing the market capitalization positions and viewing crypto assets in this way gives a user an entirely different perspective.

A Look at the Top Digital Currencies by Price per Unit

At the time of writing, there are only two crypto assets worth five-digits and only two worth four. Looking at the price of each coin per unit shows a view of how many coins are trading at certain price ranges. Price per unit recorded in this report was accounted for at 8:55 a.m. (EDT) on Sunday, July 18, 2021. Data was collected from the crypto market aggregation sites markets.bitcoin.com and coingecko.com.

Currently, a person must spend five-digits in U.S. dollars to purchase bitcoin (BTC) and yearn finance (YFI). While BTC is swapping just above $31K per unit, YFI is exchanging hands for $27.9K per token. Similarly, there are only two coins that are priced at four-digits per unit with maker (MKR) and ethereum (ETH).

Market aggregation sites show there are eleven crypto assets at three-digits per unit and bitcoin cash (BCH) lead the pack. BCH is followed by coins like compound (CMP), binance coin (BNB), and aave (AAVE) respectively.

23 Crypto Assets Trade for Two-Digits, 20 Coins Are in the Single-Digit Range

The last coin in the three-digit position is bitclout (CLOUT) which is trading just above the $100 region at the time of writing. There are only 23 crypto assets that are worth two-digits in value and the leader of the two-digit positions today is zcash (ZEC) running just under a hundred dollars.

Horizen (ZEN) and filecoin (FIL) are the only two coins in the $50 range out of the 23 two-digit cryptos. Kucoin token (KCS) holds the 23rd position and is the last two-digit coin out of the batch.

27 coins are in the single-digit range between $1 and $9 and seven of those crypto assets are stablecoins like USDT, USDC, DAI, and TUSD. Only 21 crypto coins have unit values between $0.50 and $0.99. The leader of the 21 is klaytn (KLAY) at the time of writing and the final position belongs to tron (TRX).

Of course, a number of crypto market cap aggregators are a touch different as coingecko.com has 8,545 coins recorded and coinmarketcap.com has 10,939 crypto assets recorded. Other aggregators like markets.bitcoin.com and messari.io have different numbers of recorded crypto assets as well.

Despite a few discrepancies, most of the market websites show roughly the same number of crypto assets per USD value for every unit. From this perspective, the top five coins in terms of the highest value per unit include BTC, YFI, MKR, ETH, and BCH.

What do you think about looking at the crypto economy from this perspective? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, markets.bitcoin.com,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer