The vice prime minister of Ukraine has asked all major cryptocurrency exchanges to freeze accounts of all Russian users. However, some crypto exchanges have already denied the request. Binance confirmed it is “not going to unilaterally freeze millions of innocent users’ accounts” while Kraken says it is “not really a viable business option for us.”

Ukraine Wants Accounts of All Russian Crypto Users Frozen

Mykhailo Fedorov, vice prime minister of Ukraine, tweeted Sunday asking all major cryptocurrency exchanges to block addresses of Russian users. “It’s crucial to freeze not only addresses linked to Russian and Belarusian politicians but also to sabotage ordinary users,” he tweeted.

His tweet has been widely criticized in the crypto community. One person said the request “Totally violates the foundations and very basis of cryptocurrency.”

Another pointed out: “A lot of people in Russia donate money to Ukraine, condemn the war, and crypto is one of few safe spaces for them to operate and not get jailed by own government.” Many advised, “Get your money out of exchanges,” emphasizing, “not your keys, not your coins.”

Crypto Exchanges Respond to Request to Freeze Russian Users’ Accounts

Two major cryptocurrency exchange platforms have responded to the Ukrainian vice prime minister’s request to freeze accounts of all Russian users at press time.

Binance told CNBC Monday, “We are not going to unilaterally freeze millions of innocent users’ accounts,” adding:

Crypto is meant to provide greater financial freedom for people across the globe. To unilaterally decide to ban people’s access to their crypto would fly in the face of the reason why crypto exists.

However, the cryptocurrency exchange clarified that it would block the accounts of any individuals on sanctions lists, noting that it is “taking the steps necessary” to minimize the “impact to innocent users.”

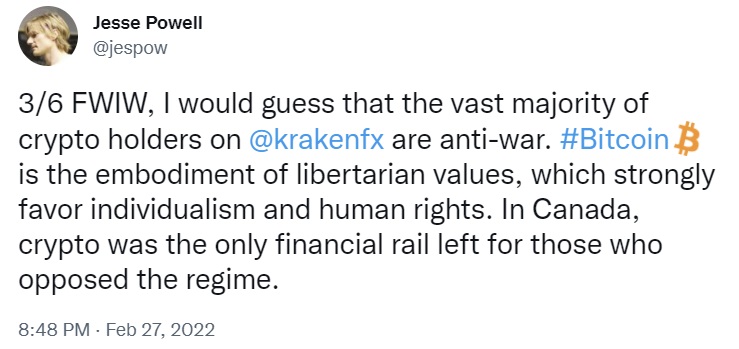

Jesse Powell, the CEO of cryptocurrency exchange Kraken, also replied to the vice prime minister in a series of tweets Sunday evening. He wrote:

I understand the rationale for this request but, despite my deep respect for the Ukrainian people, Kraken cannot freeze the accounts of our Russian clients without a legal requirement to do so.

The CEO explained: “That requirement could come from your own government, as we have seen in Canada, in response to protests, bank runs, and attempts to flee the country. It could come from foreign states, like the U.S., as a weapon to turn the Russian populace against its government’s policies.”

Recently, Powell spoke up about the Canadian government’s request for crypto exchanges to freeze accounts tied to the Freedom Convoy protest. He advised anyone who is worried about their accounts being frozen to take their coins off exchanges and self-custody them instead. His advice was red-flagged by Canada’s securities regulator.

Powell proceeded to outline Kraken’s mission is to bring individuals into “the world of crypto, where arbitrary lines on maps no longer matter, where they don’t have to worry about being caught in broad, indiscriminate wealth confiscation.”

The Kraken CEO opined:

Our mission is better served by focusing on individual needs above those of any government or political faction. The People’s Money is an exit strategy for humans, a weapon for peace, not for war.

He concluded: “Besides, if we were going to voluntarily freeze financial accounts of residents of countries unjustly attacking and provoking violence around the world, step 1 would be to freeze all U.S. accounts. As a practical matter, that’s not really a viable business option for us.”

What do you think about the Ukrainian vice prime minister’s request for crypto exchanges to freeze accounts of all Russian users? Let us know in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer