Ethereum, the largest altcoin, is still suffering from the crypto market’s dismal winter. Following intense sell-offs by traders and investors, ETH fell below the $2k threshold. According to Glassnode, the total number of addresses lost has reached 34,966,535 addresses. As a result, the purpose of the event is highlighted.

The altcoin, on the other hand, has another card in its sleeve, which ETH counted on.

Ethereum 2.0 Anticipation grows

For starters, “The Merge” alludes to the Ethereum blockchain’s long-awaited upgrade. The world’s second-largest cryptocurrency would transition to a proof-of-stake basis, removing concerns about Ethereum’s environmental impact. Improve the transaction speed as well.

To reach the ‘deflationary’ state, the claimed cryptocurrency continued to destroy a portion of its own supply in accordance with the Merge.

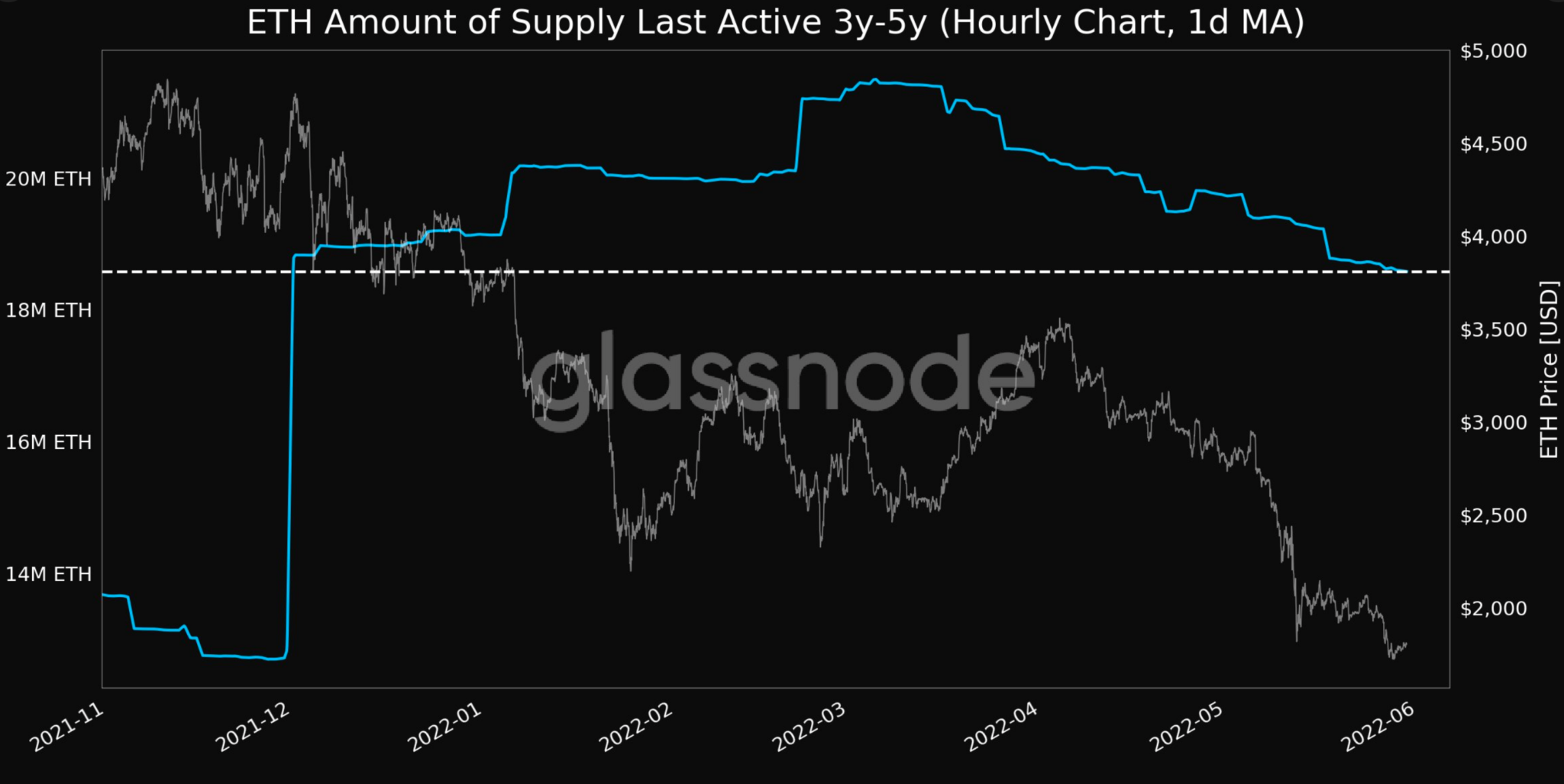

In reality, the volume of supply last active 3y-5y fell to 18,579,468.002 ETH, a 5-month low.

Source: Glassnode

The in-transit merger has benefited the largest altcoin network significantly. Investors have been preparing for the staking functionality by continuing to deposit Ether as the Ethereum network moves closer to ETH 2.0.

Related Reading | Cryptocurrency Spams Grow By Over 4000% In The Last Few Years

Source: oklink.com

The most recent statistics, as of 30 May, revealed an amazing figure. The total number of ETH 2.0 deposit contract addresses staking has reached 12,711,363, with a staking rate of 10.72 percent. This means that ETH2 holds more than 10.72 percent of all ETH currently in circulation.

The Big question

The aforementioned factors may indeed aid the flagship coin in registering a small rally in the near future. Indeed, as of press time, ETH had had an 8% increase, allowing it to surpass the $1.9k milestone.

ETH/USD trades close to $2k. Source: TradingView

Over the months, ETH’s ambitious move has hit many barriers in terms of delays. A high-level security risk known as a blockchain “reorganization” occurred recently. To make matters worse, no firm date for the “much-anticipated” upgrade has been announced.

The question remains as to how long ETH can rely on this “anticipation” to turn a profit?

Related reading | Institutional Investors Seek Safe Haven In Crypto Products Amid Market Uncertainty

Featured image from iStockPhoto, Charts from TradingView.com