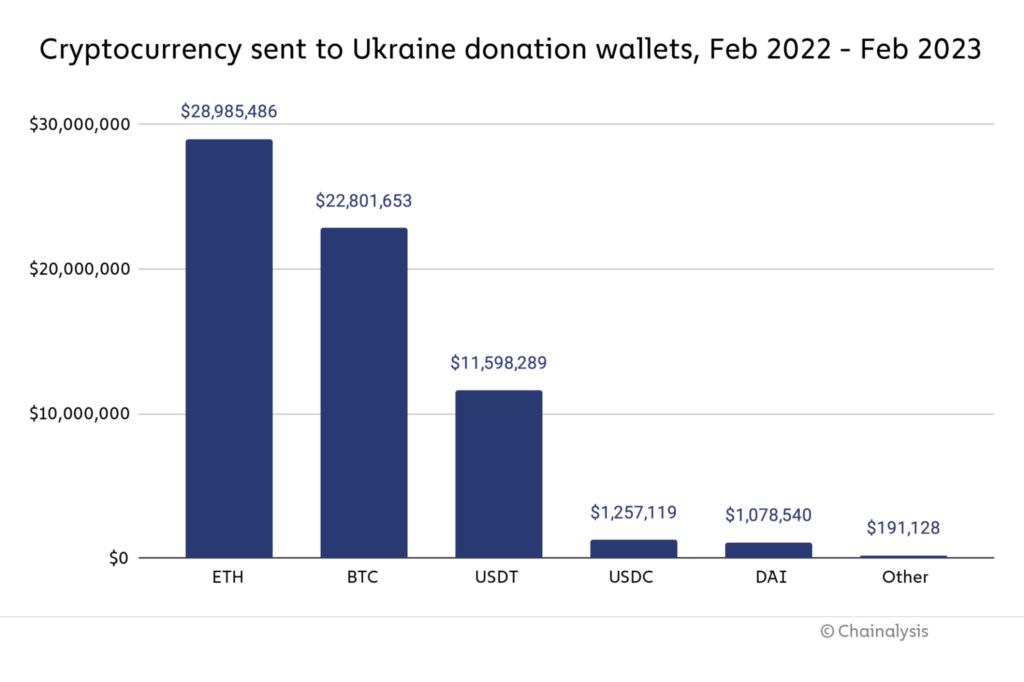

Crypto donations collected by the government in Kyiv since the start of the Russian invasion have amounted to almost $70 million, according to Chainalysis. Ether has been the most donated crypto followed by bitcoin and the stablecoin tether, the blockchain intelligence firm said in a report.

Ukraine Receives Millions of Dollars in Various Coins From the Global Crypto Community

The amount of cryptocurrency transferred to addresses published by the Ukrainian government to raise money for defense and other purposes has reached nearly $70 million, blockchain forensics firm Chainalysis revealed on the first anniversary of the conflict in the Eastern European nation.

The authorities in Kiev started accepting donations in digital currencies soon after Russia launched its invasion in late February 2022. In March, Chainalysis said that more than $56 million worth of cryptocurrencies had been donated to the wallets of the Ukrainian government.

Other digital donations have been made to addresses posted by charity organizations raising funds for their humanitarian efforts. According to a recent report by blockchain analytics company Elliptic, Ukraine supporters have sent a total of over $212 million in cryptocurrency.

“Although such donations pale in comparison to fiat donations, they demonstrate the philanthropy of cryptocurrency enthusiasts across the globe and Ukraine’s willingness to accept a wide variety of digital assets,” Chainalysis commented in its blog post. It also noted that the majority of donations were made in BTC and ETH, the leading cryptocurrencies by market capitalization.

The company pointed out that besides helping with military efforts, the donations can encourage crypto adoption and strengthen the war-hit Ukrainian economy. “Adoption by Ukraine surged over the course of the war,” Chainalysis remarked. The country ranked third in its 2022 Global Crypto Adoption Index.

At the same time, Russian adoption declined, according to the researchers, despite that side also soliciting crypto donations. The number of pro-Russian groups accepting crypto funding for their activities has grown to around 100, Chainalysis said, but they have collected less than $5.4 million.

Another finding worth noting is that in many cases, such funds are being sent to mainstream, centralized exchanges as opposed to high-risk ones – 87.3% of the digital money received by pro-Russia groups has gone to established coin trading platforms. Chainalysis also found that crypto markets are too illiquid to support large-scale Russian sanctions evasion.

Do you think the conflict between Russia and Ukraine is accelerating crypto adoption in Eastern Europe? Share your thoughts on the subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer