The price of Ethereum (ETH) has risen sharply today, hitting a new 2023 high of $2,250 as the cryptocurrency market continued to trend higher toward a successful year-end.

The recent strong upward trend in Ethereum aligns with Bitcoin’s continuous attempt to break above $41,000, which it did today. As of the time of writing, the price of bitcoin was $41.437.

Analysts say the approval of a BlackRock spot ether instrument would result in an influx of institutional capital into Ethereum, the second-largest cryptocurrency network globally.

Ethereum’s Price Surge

The most recent charts show an upward trajectory that has many analysts and investors upbeat about the cryptocurrency hitting the coveted $3,000 barrier in the upcoming weeks or months.

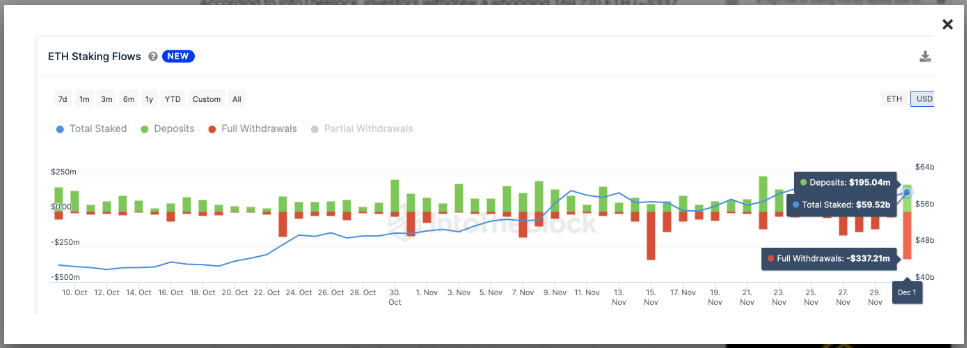

As this transpired, a crucial on-chain trade statistic reveals that, just 24 hours prior to the most recent price breakout, Ethereum 2.0 stakers made an unexpected $330 million move.

ETH Staking Flows. Source: IntoTheBlock

On December 2, investors pulled out a massive 169,220 ETH (about $337 million) from ETH 2.0 beacon chain Proof of Stake contracts, according to IntoTheBlock.

Interestingly, since the Ethereum Shapella Upgrade enabled withdrawals in April 2023, this is the second-highest staking withdrawal amount.

Resilient Rebound And Bullish Market Signals

Today, when the price of Bitcoin broke beyond the coveted $41,000 barrier, the cryptocurrency market is starting to feel more optimistic again.

The price of ETH recovered from the psychologically critical $2,000 threshold in response to this positive change, showing an 8% weekly increase to its current trading price of $2,250.

Ethereum currently trading at $2,244.7 territory on the daily chart: TradingView.com

The classic sign of a bull market is a sequence of higher lows and higher highs, which is what we observe when we look at Ethereum’s daily chart. The 50-day and 100-day moving averages served as dynamic resistance, but the price has now overcome both.

“On the basis of lower yields, cryptocurrency has been going pleasantly higher, along with Gold,” crypto data firm Amberdata stated in a newsletter on Sunday.

In a note, Lucy Hu, Senior Analyst at Metalpha, stated that there is increasing market expectation for a rate reduction in the coming year.

Investor optimism on the potential for Bitcoin ETF applications from significant asset management firms is also growing.

She states:

“This is an official declaration of a bull run, and there may be additional price increases in the upcoming weeks.”

Meanwhile, laws may also have an impact on Ethereum’s price in the future; although favorable developments may encourage investment, harsher laws may provide risks. Important factors also include investor sentiment and the state of the economy.

It’s unclear if ETH will overtake Bitcoin in market valuation; this will depend on things like adoption rates and network improvements. Right now, Bitcoin is in the lead with a far larger market capitalization.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Shutterstock