Ethereum, the linchpin of the decentralized application ecosystem, finds itself navigating a precarious path this week. The cryptocurrency’s value, having breached the pivotal $2,250 support level, now teeters on the edge of a decisive crossroads, caught between the prospect of a resurgence and the looming threat of a more pronounced downturn.

Analyzing the technical landscape reveals a cautious narrative, as ominous bearish trendlines emerge on the hourly charts of the Kraken exchange, while a resilient resistance at $2,240 presents a formidable obstacle.

Ethereum: Uphill Battle And Key Levels To Watch

The journey to reclaim lost ground demands a Herculean effort from Ethereum, necessitating the conquering of the initial hurdle at $2,240 and then engaging in a formidable battle against the $2,280 resistance. The digital asset’s fate hangs in the balance, with the outcome likely to shape its trajectory in the coming days.

ETH price action in the last week. Source: Coingecko

However, should Ethereum stumble in this uphill climb, a safety net awaits at $2,200, providing a temporary buffer against further declines. Beyond this level, a critical zone looms at $2,165, representing the last line of defense before a potential unraveling.

But amidst the technical turmoil, a ray of sunshine pierces through the clouds. Market sentiment around Ethereum remains surprisingly upbeat. Despite the price dip, the volume of net profits locked in by ETH investors has hit a multi-year high, suggesting a shift in focus from short-term gains to long-term holding.

Ethereum’s High-Wire Act: Key Metrics

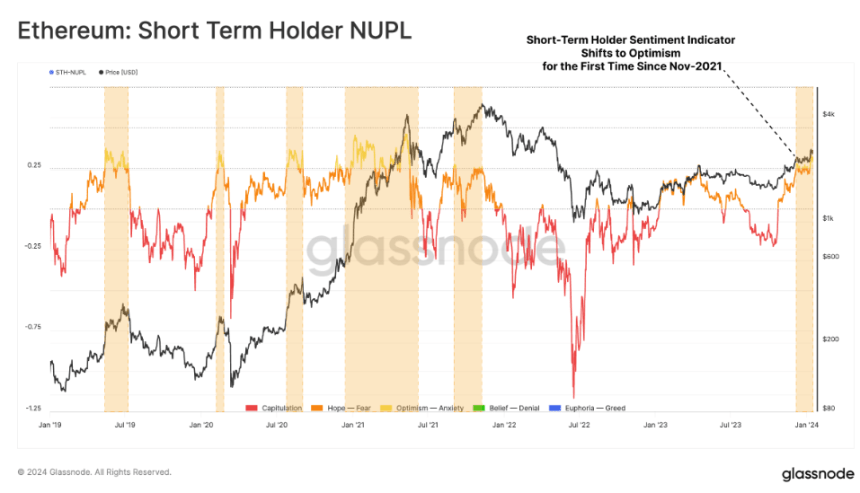

This newfound patience is further corroborated by the skyrocketing net unrealized profit/loss (NUPL) metric for short-term token-holders. This figure, reflecting the potential profitability of investors based on their purchase price, has for the first time since the November 2021 all-time high, surpassed 0.25, signifying a surge in confidence among those who recently acquired ETH.

Ethereum currently trading at $2,220 on the daily chart: TradingView.com

The current scenario resembles a high-wire act, except the stakes are considerably higher. Technical charts flash cautionary signals, but market sentiment whispers sweet nothings of optimism. Whether Ethereum finds its footing and ascends, or takes a misstep and plummets, remains to be seen.

At A Glance

- Ethereum faces near-term technical challenges with resistance points at $2,240 and $2,280.

- Support lies at $2,200 and $2,165, with a breach below $2,000 a possibility.

- Despite the price dip, market sentiment around Ethereum remains positive.

- Record-high net profits locked in and rising NUPL for short-term holders suggest long-term optimism.

While Ethereum’s path forward remains shrouded in uncertainty, the technical picture paints a potentially bleak outlook. With resistance levels looming large and support thin on the ground, a slide towards the psychologically significant $2,000 mark cannot be ruled out. However, the resilient optimism amongst investors, evidenced by locked-in profits and rising NUPL, suggests a hidden strength that could fuel an unexpected comeback.

Featured image from Pixabay, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.